$1390 Stimulus Check October 2025: $1,390 stimulus check floating around for October 2025, Stimulus checks are nothing new in the US economy. During the COVID-19 pandemic, Congress authorized multiple rounds of direct payments that were distributed to millions of people. During a time of high unemployment, these helped households pay for groceries, rent, and medical bills. The IRS is about to release their round of funding, which is a little more focused and aimed at achieving a slightly different objective than the last round.

The $1390 payment does not appear to be fully transparent, in contrast to earlier stimulus payments that were made in rounded amounts of $600, $1,200, and $1,400. The odd number suggests that a specific benefit adjustment is connected to the new checks. You can check the article to easily understand a overview of $1390 Stimulus Check October2025, and including more information.

$1390 Stimulus Check October 2025 Overview

| Category | Details |

| Payment Amount | $1,390 |

| Eligible Groups | Low- and middle-income earners, Social Security, SSDI, SSI, VA beneficiaries |

| Income Limits | Single: $75,000; Married (joint): $150,000; Head of Household: $112,500 |

| Application Required? | No (if taxes filed or benefits received); Yes (for non-filers via IRS Non-Filer Portal) |

| Payment Methods | Direct deposit, paper check, prepaid EIP card |

| Payment Date | October 2025 |

| Taxable? | No – not counted as income |

| How to Check Status | Use IRS “Get My Payment” tool or IRS online account |

Who is Eligible for the $1390 Stimulus Check October 2025?

The eligibility rules for the 2025 stimulus check are pretty straightforward, but they’re based on a few key factors like income, tax status, and whether you’re already receiving certain benefits. Here’s the scoop:

- Income Limits:

- Single filers earning up to $75,000 a year are eligible.

- Married couples filing jointly with a combined income of $150,000 or less can get it.

- Heads of household (think single parents or guardians) qualify if they earn $112,500 or less.

- If you’re getting Social Security, Supplemental Security Income (SSI), Social Security Disability Insurance (SSDI), or Veterans Affairs (VA) benefits, you’re likely in line for the payment automatically—no extra steps needed.

- Families with qualifying dependents (like kids or elderly relatives) might get extra funds, depending on their situation.

- If you filed your 2023 or 2024 taxes and meet the income limits, you’re probably good to go. The IRS will use your most recent tax return to figure out if you qualify.

- If you don’t file taxes (maybe because your income is too low or you only get benefits), you might need to take an extra step to claim the payment. More on that later.

Trump’s New H1B Visa Decision 2025: Chaos for IT Companies & Tech Workers

CRA $250 One-Time Relief Payment 2025 Eligibility, Dates & Deposit Updates

How to Check Your Payment Status?

The IRS makes it easy to track your payment. Here’s how:

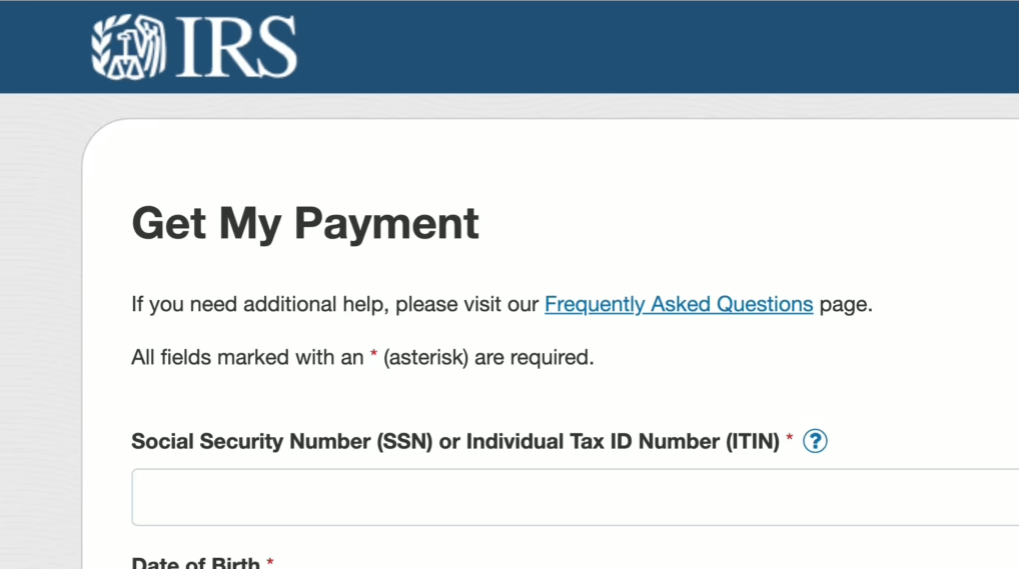

- Visit to the IRS website (irs.gov) and look for the “Get My Payment” tool. You’ll need to enter your Social Security number, date of birth, and address to see if your payment’s been processed and how it’s being sent.

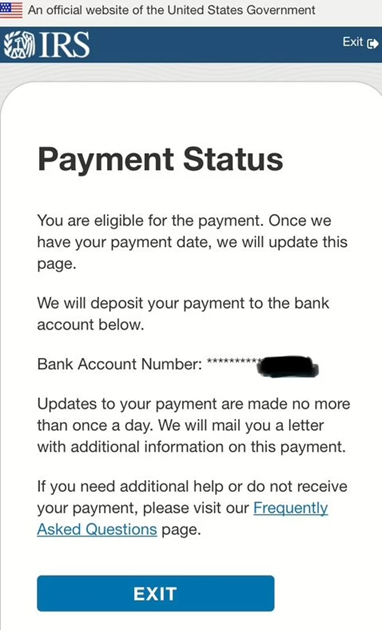

- If you’ve got an IRS account, log in to see real-time updates on your payment status. It’ll show whether it’s been sent, the delivery method, and even the date it was mailed or deposited.

- Now, If you’re still not sure, you can call the IRS at 1-800-829-1040. Be ready for a wait, though—those lines can get busy.

Fact Check

According to the official updates there will be no official confirmation about a $1390 Stimulus Check October 2025. So, be updated and use and check only the official website at irs.gov.

FAQs about $1390 Stimulus Check October 2025

Is this a new stimulus program?

No, this isn’t a brand-new program. It’s part of existing federal relief efforts, targeting people who missed earlier stimulus payments or meet the 2025 eligibility criteria.

What if I didn’t file taxes in 2023 or 2024?

If you don’t file taxes but get Social Security, SSI, SSDI, or VA benefits, you should get the payment automatically. If you don’t get any of those, use the IRS Non-Filer Portal by November 1, 2025, to claim your check.

Will I own taxes on the $1,390?

No, The payment is tax-free and won’t count as income when you file your 2026 taxes.

What if I moved or changed my bank account?

Update your info with the IRS or SSA as soon as possible. You can do this through your IRS online account or by contacting the SSA. This ensures your payment goes to the right place.