$1395 Canada GIS Allowance 2025: Guaranteed income supplement is helping millions of low income seniors in Canada to overcome their financial expenses. It is an additional payout which is linked with the old age pension program. Beneficiaries have started to receive a maximum pay out of $1097.75 in this month but the discussed amount of $1395 has not been reflected in the bank account of beneficiaries yet. Social media sources are reflecting the news of $1395 GIS payment September 2025.

If you are also looking to check the fact of this News or want to get the detail overview of the eligibility criteria for the $1395 Canada GIS Allowance program then you can read this article which will help you to understand the step by step guidelines including the application procedure, important dates to release the payment, maximum payment and the criteria to decide the payout.

$1395 Canada GIS Allowance 2025

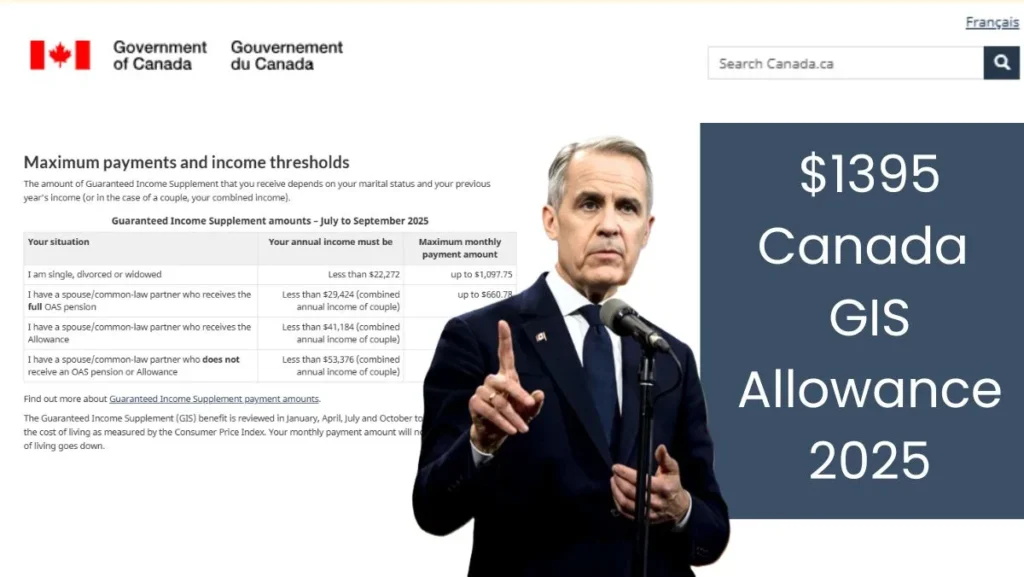

The Government of Canada is offering multiple programs for seniors in the country including Canada pension plan, old are security plan and additional payout of guaranteed income supplement. Currently the news of $1395 GIS payment is circulating on social media which is claiming that All The eligible seniors will get the maximum payout of $1395. But there is no official notification and information released by the authority regarding this increased payment. Instead of this the maximum monthly payout in GIS is $1097.75.

Who are Getting the Additional GIS Payment 2025?

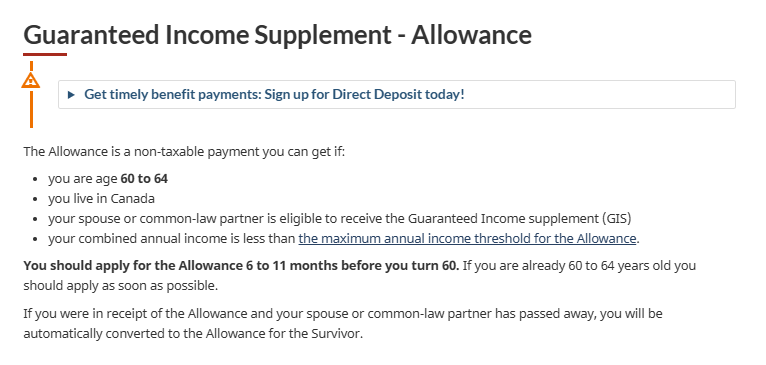

The guaranteed income supplement payment is special program which is designed only for very low income individuals who are earning less than $22500 in a year. If you are earning a very little income then the additional payout of guaranteed income supplement will automatically include in your existing OAS benefits. Check the following guidelines and requirements which are necessary to fulfill by the applicant to receive the GIS:

- The applicant is required to be a permanent citizen of Canada and living in the country for more than 10 years.

- The minimum age of the applicant should be at least 65 years old while applying for the GIS

- It is required to be an existing beneficiary of the OAS program.

- The annual income of the senior citizen should be less than $22,272 to receive the full benefit of the program. However if you are earning more than the decided income then you will also receive the benefit but it will reduce the payout accordingly.

CRA New Retirement Age 2025: Check CPP & OAS Benefits – Canada Retirement Age Increase

Canada Pension & Retirement Benefit 2025: Benefits Upto $2,461 will be Available Until December 2025

$1395 Canada GIS Allowance 2025

The calculation of guaranteed income supplement is based on two factors including the annual income of the applicant and the family condition. The range of the payment in the program is between $660 to $1097. You can check the following criteria to understand how much amount you can receive according to your condition:

| Family Condition | Annual Income Limit (Excluding OAS) | Maximum Monthly Benefit (with full OAS) |

| Single, divorced, or widowed pensioner | Less than $22,272 | Up to $1,097.75 |

| Couple, where both partners receive the OAS pension | Less than $29,424 (combined annual income) | Up to $660.78 (per person) |

| Couple, where one partner receives OAS and the other does not | Less than $53,376 (combined annual income) | Up to $1,097.75 |

| Couple, where one partner receives OAS and the other receives the Allowance | Less than $41,184 (combined annual income) | Up to $660.78 |

How to apply for the GIS Program?

Candidates are required to update the details on the Canada revenue agency dashboard where they need to login on the dashboard and select the old age pension program. They will find the section to get the benefit of guaranteed income supplement and will be asked to enter all the details including income criteria and family structure details in it. Department will verify your details from their database and after date will start to release your payment in bank account directly which will be combinedly provided with your OAS benefits.

Date of the payment

The monthly pension for seniors in Canada is usually released in the last days of the month. Department have scheduled 25 September 2025 for the payment of guaranteed income supplement and the old age pension program. So if you have completed your application and waiting for your next payment then can check your bank account after 25 September.

$7830 IRS EITC Refund 2025 Payment Date, Eligibility Rules & How to Claim

Credit One Bank Settlement 2025: Check Eligibility & Process to File Claim

Conclusion

Canada revenue agency inform all the changes and new payments on their portal to the citizens before implementing it. The information of $1395.75 is not release yet and no beneficiary have reported to receive such payment, so you should not believe such news and do not provide your confidential details to anyone to claim such fake payment. However seniors can get more than the 1000 CAD according to their financial and other conditions but there is no fix the payment of $1395 in September under the guaranteed income supplement program.

FAQs

What determines how much GIS someone receives?

Your previous year’s income, marital status (single or with spouse/common-law partner), whether partner receives OAS or not.

When is the payment date for GIS for September 2025?

For those receiving by direct deposit, the payment date is September 25, 2025.

Do you need to apply to get GIS, or is it automatic?

If you already receive Old Age Security (OAS) and meet the income requirements, GIS is automatically applied for. But if you don’t receive OAS yet, then a separate application may be required.

Does Canada increase GIS payment amounts regularly?

Yes — GIS payments are reviewed quarterly (in January, April, July, October) to adjust for inflation using the Consumer Price Index (CPI).

Are these payments taxable?

No. GIS (and OAS) benefits are not taxed. Though you must report them on your tax return, they are non-taxable payments.

Where can someone check their GIS eligibility or payment details?

On the official Government of Canada website (Canada.ca), using tools like “Do you qualify”, or via your My Service Canada / Service Canada account.