$1433 CPP Benefits for All Pensioners: Are you a retiree? Are you eligible to get the benefits from the Canadian Govt.? Even if you are near of your retirement age or already serving your golden years in Canada then also you are eligible to get the benefits. Knowing how to effectively claim your Canada Pension Plan or CPP benefits can greatly enhance your financial security just hold your breath and focus on what you are going to get.

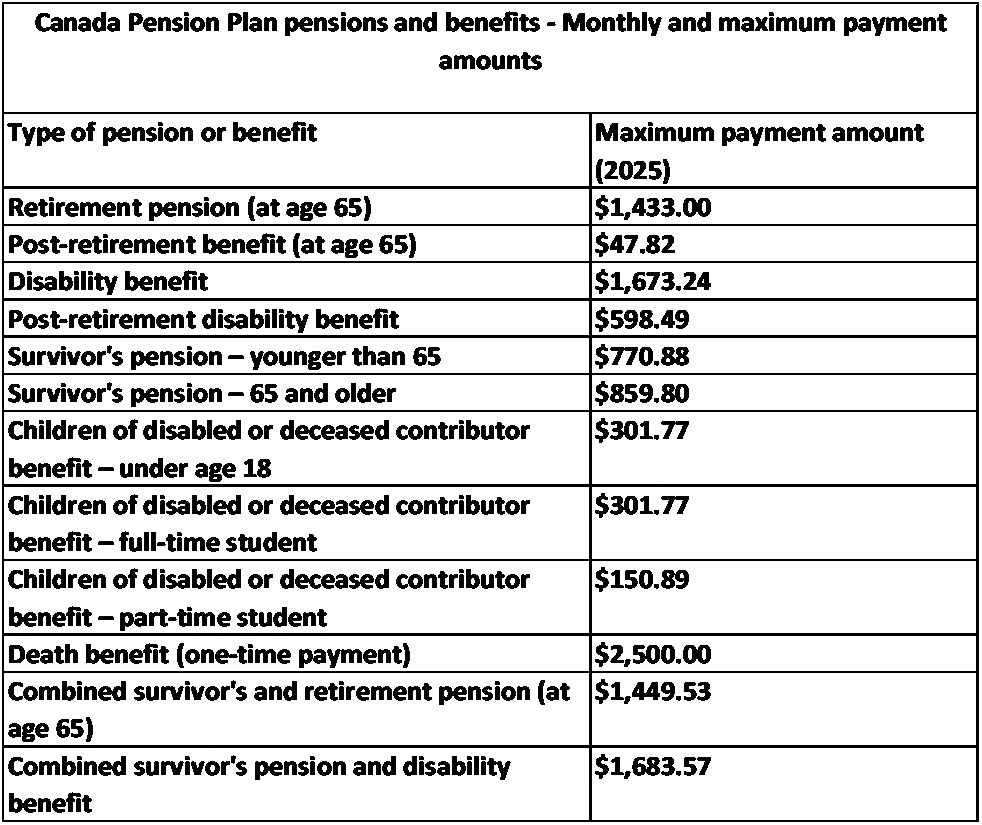

With the maximum monthly payments projected to reach $1433 in 2025. It is crucial to understand the necessary steps and the best timing for your application. If you are at you 65 then maximum amount you will get of $1433 as retirement pension and also the postretirement benefit will be $47.82.

$1433 CPP Benefits for All Pensioners

The Canada Pension Plan is an important financial relief for the citizens of Canada. Canadians have emerged themselves with various financial assistances and CPP is one of them. In 2025 there are various changes happened that will impact both current and future receivers. For a layman we can define CPP as a govt. aided retirement pension scheme which is specially designed to provide financial assistance to the retirees who are eligible along with who are survivors and individuals with disabilities.

And now the question arises that what is the origin of funding? How are these schemes running? So, to clear the confusion let me add that it is funded through mandatory contributions from employees, employers, and self-employed individuals, aiming to replace a portion of a worker’s earnings during retirement or in the event of disability.

$1433 CPP Payment Amount and Date

if an applicant is 65 years of old then he will get $1433 as the maximum amount for the CPP retirement pension has raised in 2025. This marks an increase of about 2.4% compared to last year’s highest payment. The actual pension amount is determined by several factors. Those are

- one person’s highest earning during his working period

- the total number of years you contributed to the CPP

- the age at which you are choosing to start your pension

- already you are receiving the payment or not

For many claimants the average monthly payment is around $770 for those who are under 65 which are significantly lower than the maximum amount. This difference arises because not many Canadians contribute the maximum for the entire contribution period.

Also note that if you are applying after turning 65 then you are eligible to get retroactive payments. The Service Canada can pay retroactive amounts for the CPP retirement pension for a maximum of 12 months (11 months plus the month you apply) which will start not early the your 65th birthday. There are no retroactive payments for pensions taken before age 65.

In March the payment date will be 27th. That means the payment will be distributed on 27.03.2025.

$3900 Monthly Senior Payment in March 2025: Who is Eligible and When Payment Will be Coming?

iPhone 16 Pro Max Big discount of ₹17695 on Amazon: Features⬆️ Price⬇️ See Complete Details

CPP Payment Benefit

- This decision is somehow hard to calculate. As this can affect on how much you will get as per your age and other factors. It may decrease the value you will have.

- If you are an applicant and your age is in between 60-64, then it will be considered that you are applying early which can reduce the amount you will have in your account as the benefit.

- Likewise if you are an applicant and want to apply at your 65 then it is right time that you can avail the benefit. At this age you will get standard amount which is set by the Service Canada.

- If you are an applicant and you are applying lately at your ages in between 66-70 then your benefit will go up by 0.7% for every month after you turn 65, with a total possible increase of 42% by age 70.

How to apply for CPP?

- Applying online can make the process smooth and easy.

- At first the claimants have to log in or create a My Service Canada Account (MSCA) on the official Government of Canada website.

- Then you will notice that there is a tab of “Apply for Canadian Pension Plan” option is there. So choose that.

After choosing fill all the required details like

- Your personal information

- Banking information for direct deposit

- Employment history

- Children’s information (if needed for child-rearing provisions)

- You can kindly review once before submitting the form.

- After submission you will be redirected to download the confirmation page of your application. So save or print your confirmation page for your records.

How can you opt for tax benefits?

CPP income is a taxable income. So to minimize the risk of bulk deduction at a time you can request or apply for the deduction on monthly basis by log in to service Canada Account or by filling out the Request for Voluntary Federal Income Tax Deductions CPP/OAS (ISP3520CPP) form and sending it to us or delivering it to a Service Canada office. If you will not opt for monthly reduction you might need to pay your income tax quarterly. For more such details, kindly visit Service Canada website.