3 New CRA Benefit Payments October 2025: Various types of schemes are run by the Canada Revenue Agency in Canada. The main objective of these schemes is to help families with low and minimum income. Under this help, financial assistance is given to the people of the family so that they can deal with the rising inflation and meet their necessary expenses. In this sequence, the Canada Child Benefit, Ontario Trillium Benefit, Canada Pension Plan and Old Age Security Scheme are being operated by the Canada Revenue Agency. These schemes are given to those families in which there are elderly, children and people of economically weaker sections are present.

The main objective of these 3 major CRA schemes is to provide financial assistance to millions of families, elderly, and lower-class people of Canada so that help can be provided in the upbringing and education of children. At the same time, the increasing burden of energy, property tax, and sales tax can be reduced. Apart from this, senior citizens can also be provided a pension for a safe and stable life.

Recently, special changes have also been made under these schemes, in which improvements have been made in the Canada Child Benefit and the Ontario Trillion Benefit from July, and the benefit amount has been increased. At the same time, new updates were made in January 2025 under the Canada Pension Plan, which has increased the benefit amount.

3 New CRA Benefit Payments October 2025

In today’s article, we will discuss these 3 big CRA schemes in October 2025 in detail, where we will explain how these three schemes are being operated in Canada. At the same time, by when will the benefit amount come into the account under these CRA schemes in the coming time? Along with this, we will also provide details of the eligibility criteria to avail these schemes so that you can also get information about these three special schemes run by the Canada Revenue Agency, and if you are an eligible and interested candidate for these schemes, then you can apply to get their benefit as soon as possible.

Canada Child Benefits

The Canada Child Benefit Scheme is mainly provided to those families where the income level is very low but children are present in such families and parents are not in a position to spend on children.In such a situation, this scheme is operated to help the parents so that parents can spend on the education and nutrition of children. Under this scheme, children below 6 years of age get $7997 per year. At the same time, $6748 is given per year for children between 6 and 17 years, under which a monthly amount of $600 to $500 is transferred to the account every month.

CCB Eligibility 2025

The eligibility under this scheme has been determined as follows:

- The applicant must be a permanent resident of Canada.

- The applicant must have children below 18 years of age in his family.

- The applicant can be a parent or guardian of the children.

- If there are cases of joint custody, then the benefit of this scheme is given to the parents separately.

- Apart from this, if the applicant is a temporary resident, then it is necessary to have a valid residence certificate of at least 18 months.

- The benefit amount of this scheme depends entirely on the income level of the family; the lower the income, the greater the benefit.

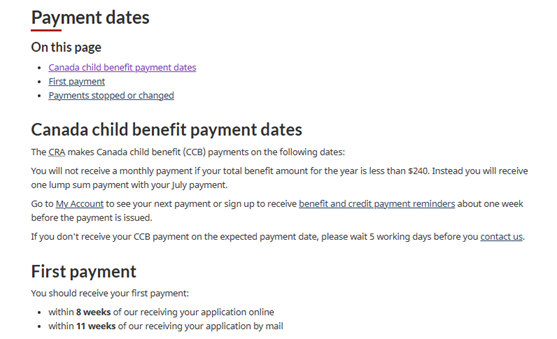

CCB Payment Date 2025

Let us tell you that under this scheme, the payment for the month of October will be transferred to the account by 18 October, 2025. In the future, this payment is going to be transferred on 20 November 2025, and 12 December 2025.

- October 18, 2025

- November 20, 2025

- December 12, 2025

Ontario Trillium Benefit

Under the Ontario Trillium Benefits scheme, discounts are provided in energy bills, property tax, and sales tax. This scheme has been started mainly for the residents of Ontario so that the daily expenses of the people living in this city are reduced and there is no financial burden on them. Under the Ontario Trillium Benefits Scheme, different benefit amounts are provided to the candidates, in which $371 is given per child under the Ontario Sales Tax Credit.

Under the same Ontario Energy and Property Tax Credit, $1283 per year is given to the general citizen and $1461 per year to senior citizens. Apart from this, $185 per person and $285 are given to the family in Ontario Energy Credit.

Ontario Trillium Benefit Eligibility

- To avail the benefits of this scheme, the applicant must be a resident of Ontario.

- It is also mandatory for the applicant to file tax returns from time to time.

- The benefit of this scheme is given only to low-income families.

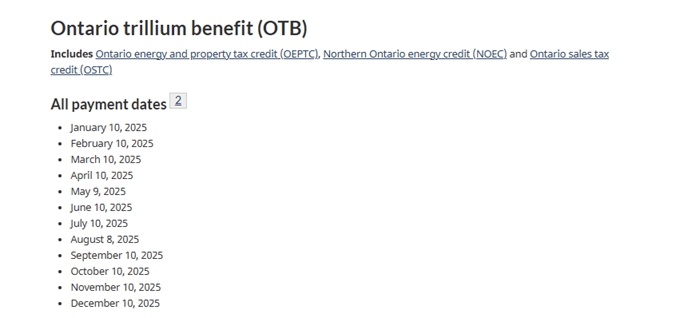

OTB Payment Dates

Let us tell you that under this scheme, the payment amount is going to be transferred to the accounts in the month of October till 10 October 2025. The next payment will also be transferred on 10 November, and 10 December.

- October 10, 2025

- November 10, 2025

- December 10, 2025

Canada Pension Plan and Old Age Security

This scheme has been started by CRA for senior citizens so that pension assistance can be provided to senior citizens living in Canada. So that they do not have to depend on anyone else in old age. Through the scheme, the Government of Canada provides different benefits of CPP and OAS to senior citizens. Under CPP, citizens above 65 years of age are given $1433per month. At the same time, under OAS, citizens above 65 years of age are given $734 per month, and citizens above 75 years of age are given $808per month.

CPP and OAS Eligibility

- To avail the benefits of this scheme, the applicant must be a resident of Canada.

- The applicant must have all the documents to be a permanent resident of Canada.

- It is mandatory for the applicant to contribute at least a few years of his career while living in Canada.

- Apart from this, only citizens 65 years of age are included under this scheme, in which the later the pension scheme is started, the more benefits are received.

- The benefit of this scheme will be transferred to the accounts of the candidates by 25 September 2025 in September.

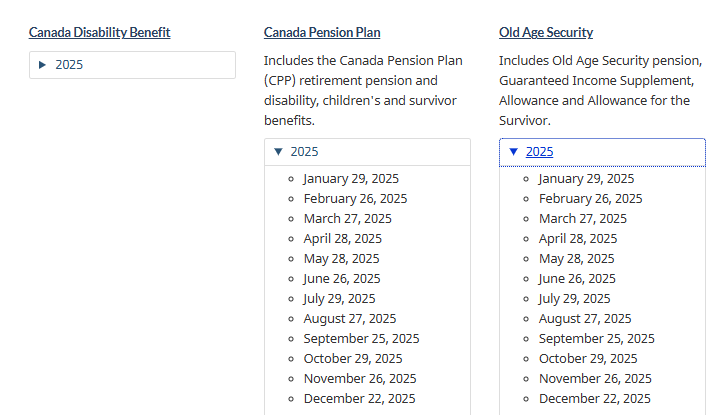

CPP and OAS Payment dates

- 29 October 2025

- 26 November 2025

- 22 December 2025

How to Apply for CRA Schemes 2025?

- To avail the benefits of these Canada Revenue Agency CRA Schemes 2025, the applicant does not need to apply separately.

- The applicant is only required to be a permanent resident of Canada, and the applicant must be registered with the Canada Revenue Agency.

- Also, the applicant must have a bank account, and it is mandatory to file tax returns for the application.

- From time to time, the applicant’s account and documents are reviewed by the government, and if found to be a suitable candidate, the applicant is declared a beneficiary of the Child Benefit, Ontario Trillion Benefit, and Canada Pension Plan.

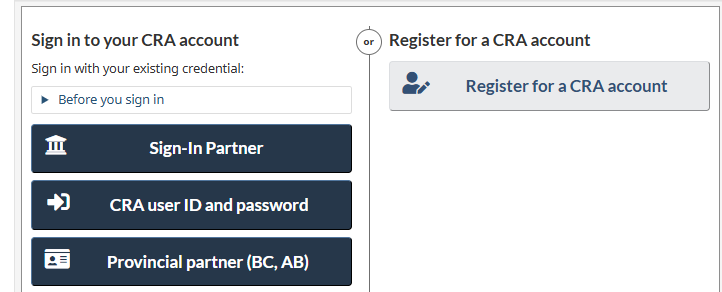

- However, if a person wants to check the status of the benefits of these three schemes, he can visit the official website of the Canada Revenue Agency and log in to the My Account portal to see his details.

FAQs About 3 New CRA Benefit Payments October 2025

What is the payment date for the Canada Child Benefit (CCB) in October 2025?

The CCB payment for October 2025 is scheduled for 18 October.

When will the Ontario Trillium Benefit (OTB) be paid in October 2025?

The OTB payment date is 10 October 2025.

On what date will CPP (Canada Pension Plan) payments be made in October 2025?

CPP payments are scheduled for 29 October 2025.

What about Old Age Security (OAS) payments for October 2025?

OAS payments (including supplements) will also be issued on 29 October 2025.

How are payments delivered for these benefits (CCB, OTB, CPP, OAS)?

Payments are typically made by direct deposit, managed through CRA’s “My Account” or related benefit portals.

Who is eligible for these benefits?

CCB: Families with children under 18, income‐based eligibility.

OTB: Ontario residents who meet provincial criteria (energy, property tax, sales tax credits).

CPP: Those who contributed in their working years, survivors/disability components accordingly.

OAS: Seniors (65+), meet residency requirements; supplements for low income.

Where can recipients check their payment dates or view updates?

Through the official Canada.ca benefits calendar and CRA’s “My Account” portal, where payment schedules, eligibility, and benefit rate information are published.