$667 Centrelink Newborn Benefit 2025: Growing a kid is not an easy thing to do. When a new infant born in the family, it creates a scope of financial responsibility. So to support the Australian families during this significant time the government has introduced the Centrelink Newborn Payment. In 2025 the families are going to receive a one-time payment of $667 along with additional benefits to help cover the costs associated with newborns. In this article you will get to know about the payment amount, detail criteria of eligibility, application procedures, payment timelines and other available benefits.

The Australian govt. is offering various financial support options for parents and families including one-time payments for the birth of a child and ongoing assistance for childcare expenses. The parents who are caring for their child can qualify for the $667 Centrelink Newborn Payment in 2025. This financial assistance will be distributed to eligible individuals and it will also lead to an increase in Supplement A of the Family Tax Benefits.

Let’s discuss more about Centrelink Newborn Payment 2025:

The purpose of Centrelink Newborn Payment is to provide financial assistance to the families who are parents of a newborn child. In 2025 the eligible parents will receive a onetime payment of $667 for each child. For 13 weeks of duration they may receive for ongoing assistance of up to $2003.82 based on their income and personal situation. The families who are having more than one child they will receive an extra $668.85 for each additional child during. These payments are tax-free. By which the families can get full amount. The federal agency named Services Australia plays a crucial role in delivering this financial aid to residents.

| Centrelink Newborn Benefit 2025 | |

| Topic is about | $667 Centrelink Newborn Benefit 2024 |

| purpose | Provides economic support |

| Eligibility | The child should be in the care for at least 13 weeks |

| Payment | $667 |

| Category | Finance |

| Government | Australia |

| Year | 2025 |

| Resources | https://www.servicesaustralia.gov.au/ |

Eligibility Criteria: $667 Centrelink Newborn Benefit 2025

- The applicants or the parents have to meet certain eligibility criteria.

- The applicants need to be a resident of Australia and they should the primary caregivers of a newborn or adopted child.

- They must be eligible for Family Tax Benefit Part A which depends on factors such as income, residency, and the ages of the children.

- On the ground of income threshold,

- The applicant’s income should be below $1,368 every fortnight and their partner’s income must not exceed $2,568.34 during the same period.

- The combined household income must be less than $2,736 every two weeks.

- Just remember that one cannot receive both Parental Leave Pay and the Newborn Payment for the same child simultaneously.

- The child’s birth must have been registered with the government to ensure the viability.

- The basic condition has to be satisfied that you must have a child, either through birth or adoption.

- And also remember that you will not qualify if your partner is receiving cash payments for the child or if both parents have taken family leave for the child.

Payment schedule and time: $667 Centrelink Newborn Benefit 2025

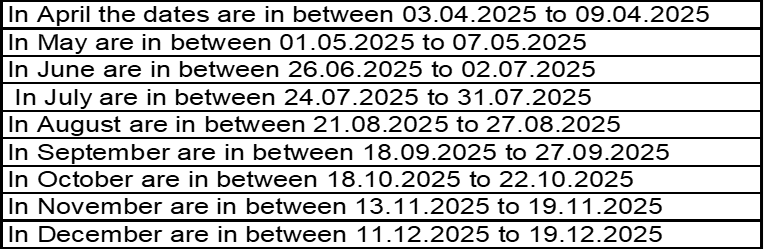

Just stay updated to know your payment date. Payments will be distributed in the intervals which is monthly. The dates are fixed or prescribed by the Service Australia.

The scheduled payment periods are as follows:

Procedure to apply: $667 Centrelink Newborn Benefit 2025

For old applicants:

If you are not a new applicant and already registered with Service Australia then you will receive the payment automatically. That means they don’t need to apply freshly.

For New applicants:

- If you are eligible to get the payment then create an account on myGov by visiting their website.

- Then link your account by giving CRN.

- After that, complete all the necessary documentation. So before applying first gather all the necessary documenters including proof of birth or adoption, identity verification and income information.

- You can submit a claim for Family Tax Benefit Part A through your myGov account that is connected to Centrelink.

- Once your claim got the approval Centrelink will automatically assess your eligibility for the Newborn Payment.

- You can track the status of your application using the Express plus Centrelink app or by visiting the myGov website.

- After that, check all the documents thoroughly to avoid the delays.

- Then submit supporting documents that verify your residency, income, and financial situation.

Extra child care Benefits:

To make easier for the parents, Australian Govt. has developed so many child related benefits which can be enjoyed by the citizens. In addition to the new born payment there is Parental Leave Pay which supports parents who are on leave to care for their newborns along with the Child Care Subsidy which helps in covering the day care expenses. Also Dad and Partner Pay offers up to two weeks of government-funded leave for fathers or partners.

Conclusion:

Centrelink is offering greatest opportunities for the parents who are livening and raising their children. Early application and staying updated can bring you to get the benefit from government assistance during this significant time in your family’s life. The $667 Newborn Payment from Centrelink plays a crucial role in helping families manage the financial responsibilities that come with a new baby. By knowing your eligibility, staying informed, and utilizing additional support services, you can better prepare for this joyous occasion.