Canada Grocery Rebate October 2025: The Canada Grocery Rebate in October 2025 is a one-time, tax-free payment designed to help Canadians cope with rising grocery costs. With food prices on the rise, this government initiative aims to provide some extra financial support to low- and modest-income families and individuals. Whether you’re a single adult or a family with children, this rebate could help ease the strain on your monthly budget.

Grocery prices have been steadily rising, causing sticker shock for many. The government’s Grocery Rebate program offers much-needed relief, providing cash directly to your bank account or mailbox to help offset the impact of inflation. Even better, if you receive the GST/HST credit and have already filed your 2024 taxes, the payment will be automatically deposited, no additional application required.

Canada Grocery Rebate 2025 Overview

| Aspect | Details |

|---|---|

| Program | Canada Grocery Rebate 2025 |

| Administered By | Canada Revenue Agency (CRA) |

| Country | Canada |

| Month | October 2025 |

| Eligibility | Based on 2024 tax return; Canadian resident; 19+ years or younger with family |

| Payment Type | One-time, tax-free, linked to GST/HST credit |

| Payment Amount Range | $234 (single, no children) to $628 (families with 4 children) |

| Delivery Method | Direct deposit or mailed cheque |

| Official Website | www.canada.ca |

Eligible For Canada Grocery Rebate October 2025

1. Canadian resident for tax purposes

2. Filed a tax return (for the relevant year, e.g., 2021 for 2023, or 2024 for speculative 2025)

3. Be age 19 or older, unless you have a spouse, partner, or a dependent child

4. Adjusted family net income below set thresholds (which vary depending on family situation)

5. Automatically determined, no separate form or application needed in most cases

$1000 PFD Stimulus October 2025: Check Eligibility and Full Payment Schedule

Centrelink Age Pension Increase 2025: $1,178.70 Amount, Eligibility & Updated Payment Dates

How to Check Payment 2025

If you believe you should receive a rebate or credit in October 2025.

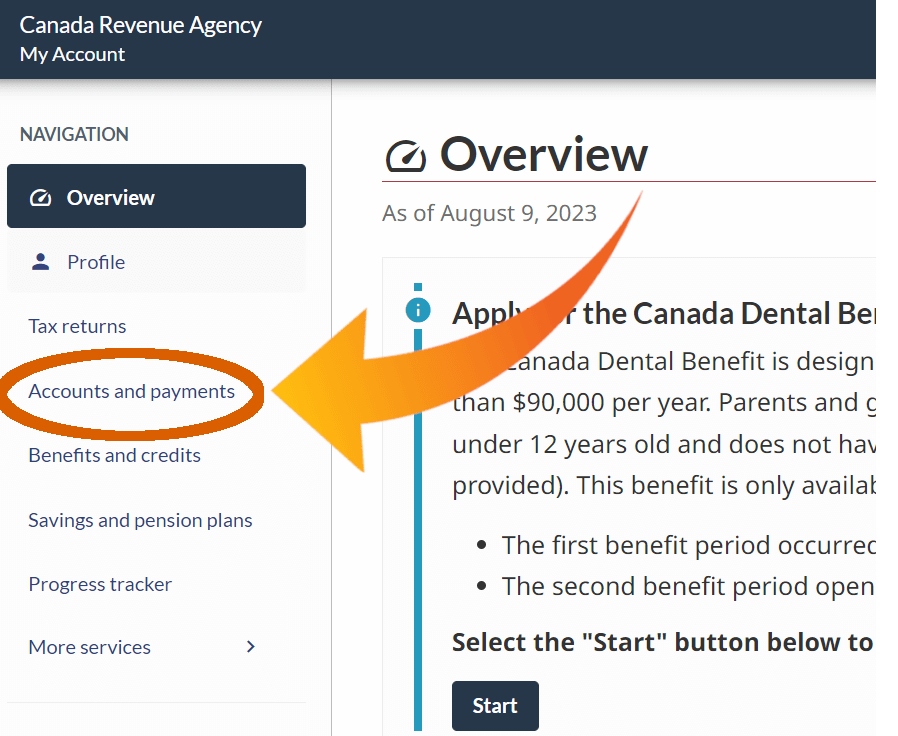

1. CRA “My Account” Portal

The best place to start is the CRA’s My Account (for individuals) online portal. Through there, you can:

- View your Benefits and Credits section

- Look for entries for “GST/HST credit” or “Grocery Rebate (Oct 2025)”

- Confirm your banking and mailing info is up to date

- Check whether your tax return has been assessed and processed

2. Check Bank or Bank Statements

If you are enrolled in direct deposit:

- Look for a deposit labelled something like “CANADA Revenue” or “Credit – CRA”

- Some recipients from past payments reported that the rebate was combined with the GST/HST credit deposit.

3. If Paid by Cheque

If you are not enrolled in direct deposit, the payment may arrive via mailed cheque:

- It may take 5–10 business days after the official payment date for you to receive it.

- Monitor your postal mail and ensure your address with CRA is current

4. If You Don’t See Payment

If you believe you should have been paid but see no deposit or cheque:

- Wait at least 10 business days after the expected payment date.

- Confirm your tax return for 2024 was filed and assessed

- Check and update your CRA My Account information

- Contact CRA (via its official contact lines) for help.

Payment Of Canada Grocery Rebate October 2025

| Household Type | Estimated Rebate Amount (CAD) |

|---|---|

| Single adult (no children) | $234 |

| Single parent, 1 child | $387 |

| Couple, no children | $306 |

| Family with 2 children | $467 |

| Larger family (3+ children) | Up to $548 to $628 |

Are there any rebates in 2025 Canada?

The Canada Carbon Rebate (CCR) program ended in 2025. The last payment was issued starting April 22, 2025. To receive the payment on time, you had to file your 2024 income tax return electronically by April 2, 2025. If you filed your return later, you will receive your payment once your return has been processed.

What is the $300 federal payment in Canada in 2025?

The $300 federal payment in Canada 2025 is a one-time benefit designed to provide targeted support for low and modest-income individuals and households. It aims to help Canadians cope with rising costs and alleviate financial stress.

How to apply for grocery rebate in Canada?

- You must be a tax resident of Canada.

- You must be at least 19 years old, or under 19 with a spouse or child.

- You must have filed your 2024 income tax return.

- Your adjusted family net income must be below a certain threshold.

- If you receive the GST/HST credit, you are automatically eligible for the rebate.

FAQs Canada Grocery Rebate October 2025

Is the Canada Grocery Rebate still active in 2025?

No. The official CRA page for the Grocery Rebate has been archived, and the program is no longer active.

What will Canadians receive in October 2025 instead?

Most eligible recipients will receive the GST/HST credit, which is a recurring benefit for low- and modest-income households.

Do I need to apply to get a rebate or credit?

In the past, no application was needed for the Grocery Rebate — eligibility was based on your tax return and GST/HST credit eligibility.

How do I check payment?

Use CRA My Account to review your Benefits & Credits section, confirm your banking and address, and check for payment entries. Also monitor your bank statement or watch for mailed cheques.