Canada GST/HST Credit October 2025: The Government of Canada provides GST/HST credit to low- and middle-income families from time to time every quarter. This is a tax-free benefit where low- and middle-income families are given relief from the GST/HST burden. That is, families who are earning low income are provided financial assistance every quarter in lieu of paying GST/HST on the purchase of goods so that the burden of GST/HST paid by them can be reduced. Due to which they get financial assistance every quarter.

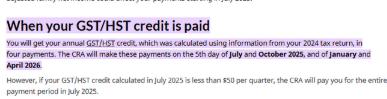

This GST/HST credit is given four times a year in July, October, January, and April. This credit is transferred in the form of cash to the account of all eligible citizens. Let us tell you that for the year 2025-26, the credit amount has also been determined, and this credit is going to be transferred to the account of the candidates soon.Under this Canada GST/HST Credit, single individuals will be given $519, married and live-in couples will be given $680, and children under the age of 19 will be given $115 to $179 annually. However, to avail the Canada GST/HST Credit benefit, it is mandatory for all candidates to submit tax returns under the Canada Revenue Agency.

Canada GST/HST Credit October 2025

| Article | Canada GST/HST Credit October 2025 |

| Payment | GST/HST Credit Payment |

| Issuing Agency | Canada Revenue Agency |

| Canada GST/HST Credit Eligibility | Canadians who files recent return |

| Frequency of the Payment | Quarterly (Every 3 Months) |

| Canada GST/HST Credit October 2025 Dates | 5th of each Quarter First Month |

| CRA Official Website | www.canada.ca |

Canada.ca GST/HST Tax Credit 2025

As we said, the Government of Canada and the Canada Revenue Agency are soon going to transfer the GST/HST credit details of the financial year 2025-26 to the account of the eligible candidate. In such a situation, the Canada GST/HST credit for the month of October is going to be transferred soon, for which the candidates have to ensure that their tax return is deposited; otherwise, they will not get the GST/HST credit for the month of October.

However, before this, the payment of July has been completed on the basis of the tax return of 2024 till July 1, 2025, and now Canada. ca The GST/HST tax credit payment for October is going to be made on October 5, 2025. We are going to give you complete information related to the GST/HST Credit in October 2025 in Canada, where we will tell you the eligibility to get this GST/HST credit and complete details of checking the GST/HST Credit payment status.

What is GST/HST credit?

GST/HST credit is a tax-free payment. This Canada GST/HST Credit for October 2025 is provided by the Canada Revenue Agency to low-income and middle-income families. GST / HST includes GST, i.e., Goods and Services Tax, and HST, i.e., Organized Sales Tax; through this, low- and middle-income families get help in compensating the expenses incurred from GST / HST. Usually, whenever a person living in Canada buys any goods or services, he has to pay GST/HST.

GST/HST tax has to be paid by rich and poor alike on the purchase of goods and services.But this tax becomes a burden for low-income people, and to eliminate this inequality, the GST/HST Credit scheme is run by the Canada Revenue Agency, in which a special amount is given to the low- and middle-income families four times a year in the accounts so that the burden of tax they have to pay on the purchase of every good or service can be reduced.

The most special thing about the Canada GST/HST Credit is that it is tax-free. Meaning when this amount comes to your account, no tax has to be paid on it. It is credited four times a year in July, October, January, and April. Candidates do not need to apply separately to get this benefit. However, it is mandatory for the candidates to have filed the previous year’s tax with the Canada Revenue Agency, and in today’s article we will give you the details of the GST/HST Credit of October 2025.

Benefits of CRA GST/HST Credit Deposit

- Under GST/HST Credit 2025, people of low- and middle-income groups get direct savings in their accounts.

- As we said, no tax is levied on it, so it provides relief to all citizens.

- The amount received through this credit improves the condition of the people.

- This amount received four times a year provides economic stability.

- All those citizens who already belong to the low-income group and, while buying goods, have to pay GST / HST tax, due to which even cheap goods start appearing expensive to them, and this credit gives them financial benefit again so that they can buy the necessary goods four times a year without worrying about GST / HST.

- The Government of Canada also includes additional tax credits along with the GST/HST credit in specific provinces and territories such as Ontario, Trillion Benefit, B Climate Action Tax etc.

CRA GST/HST Credit Eligibility 2025

Some eligibility criteria have been set to avail GST/HST Credit which are as follows:

- This CRA GST/HST benefit for 2025 is given only to permanent residents of Canada.

- To avail this scheme, the candidate must be at least 19 years old.

- And if the candidate is younger, then it is mandatory for him to live with a family/guardian/couple.

- To avail this scheme, it is mandatory for the candidate to have filed the tax return of the previous year.

- That is, if the candidate wants to avail the GST/HST credit benefit in 2025, then the tax return of 2024 must be filed even if the candidate has no income.

- If the candidate is a new resident of Canada, then he may have to fill out Form RC 151 or RC 66 to avail this benefit.

- These two forms are different; one form is for families who have children, and one form is for families without children.

- To avail this benefit, the Canada Revenue Agency has determined the income limit of the candidates. If the income of the candidate is within the stated criteria, then only they get the benefit of this scheme.

CRA GST/HST Tax Credit Deposit Dates 2025

The Canada GST/HST Tax Credit is deposited 4 times annually. In 2025, the CRA GST/HST tax credit scheduled payment dates are:

- 03 Jan, 2025

- 04 Apr, 2025

- 04 Jul, 2025

- 03 Oct, 2025

GST/HST Credit Payment Date: October 2025

- GST/HST Credit will be issued by CRA from 3 to 5 October 2025. This payment will be made within these working days.

- Under this payment process, a single person will be provided $533 annually, i.e., $133.25 quarterly.

- At the same time, married couples will be given $698 annually, i.e., $174.5 quarterly.

- Apart from this, for children under the age of 19, $184 per child annually, i.e., $46 every quarter, will be provided.

How to Apply for the Canada GST/HST Credit Payment 2025?

There is no need to make a separate claim to get GST/HST credit. All those candidates who file tax with CRA are automatically declared as beneficiaries of this scheme. However, if a resident has recently come to Canada, then he has to fill out the forms. Form RC 66 is for those who are availing benefits under the Canada Child Benefit Application, and Form RC 151 is for those who do not have children. New residents have to fill out both these forms as per their convenience and send them to CRA. CRA calculates this credit based on the tax status of the candidates, and the eligible beneficiaries get a GST/HST credit notice. In which the payment is credited to the bank account every quarter.

Conclusion: Canada GST/HST Credit October 2025 Payment Date

Overall, if you are also a resident of Canada and are waiting for the next payment of GST/HST Credit, then this payment amount can come to your account in the month of October.However, for this you will have to go to the CRA portal and update the information by clicking on the My Account option and file your return as soon as possible, and after the payment is made, you can see the complete details of your payment status by logging into My Account on the CRA portal.

FAQs About Canada GST/HST Credit October 2025

When will the GST/HST Credit be paid in October 2025?

The CRA will release the GST/HST Credit in October 2025 on the scheduled payment date.

Who is eligible for the October 2025 GST/HST Credit?

Low and moderate-income individuals and families in Canada qualify.

How much will I get from the October 2025 GST/HST Credit?

The amount depends on your income, marital status, and number of children.

Do I need to apply for the GST/HST Credit October 2025?

No separate application—filing your income tax return automatically applies you.

Will everyone in Canada get the GST/HST Credit in October 2025?

No, only eligible taxpayers meeting CRA criteria will receive it.

How to check October GST/HST Credit status?

Through your CRA My Account or by calling CRA support.

Is the Canada GST/HST Credit taxable?

No, the GST/HST Credit is a tax-free benefit.