Centrelink Age Pension Scheme 2025: Retirement is a stage where senior citizen needs proper assistance foe their survival. In Australia, the govt. has introduced financial assistance named Age Pension which provides eligible retirees with up to $3,300 per month. When people prepare themselves for retirement it cannot be easy for them to manage the daily expenses. So to ease their survival Australia offers a support system to help seniors enjoy a more comfortable life. It is important for seniors to understand their rights and benefits. So the applicants have to be aware about how the Age Pension operates, who is eligible and the application process can empower retirees to secure their financial well-being in their later years.

As the population hitting the height people needs meet their basic needs such as housing, food, and healthcare. This benefit is managed by Centrelink. Centrelink manages all the social security payments in Australia. This Age pension stimulus is distributed among the beneficiaries monthly.

| Particulars | Details |

| Maximum Payment for couples | up to $3300 AUD |

| Maximum Payment for Single applicant | up to $2498 AUD |

| Age Limit | 67 years or older |

| Ground of Residency | Minimum of 10 years in Australia (with at least 5 years continuous) |

| Income and Asset threshold | Yes there are asset and income threshold. |

| Application Methods | Online (myGov), paper forms, in-person |

| Official Site | Services Australia |

Centrelink Age Pension Scheme:

Basically the Age Pension scheme has its own purpose to help the senior citizens of the Australia to maintain a basic standard of living. The applicants have to be eligible enough to get this financial support by fulfilling the specific age and residency criteria. These payments are administered by the Service Australia or The Centrelink. So stay updated to know about the amount to get and the whole process.

When retirement comes near to the door many people inquire about various government benefits, they may qualify for including the Age Pension and concession cards and also often they have the curiosity to know about certain questions like “What is the amount of the Age Pension?” and “What are the applicable Age Pension rates for me?”. So this article will give you all the answers. Stay connected.

Eligibility Check:

- The applicants need to be permanent residents of Australia and also have lived in the country for duration of 10 years and continuously at least for 5 years.

- There are some exceptions for individuals from countries that have social security agreements with Australia where time spent working in those countries may count towards the residency requirement.

- On the ground of age the applicants need to be at least 67 years old.

- There are certain conditions in getting the pension amount on the ground of asset and income threshold.

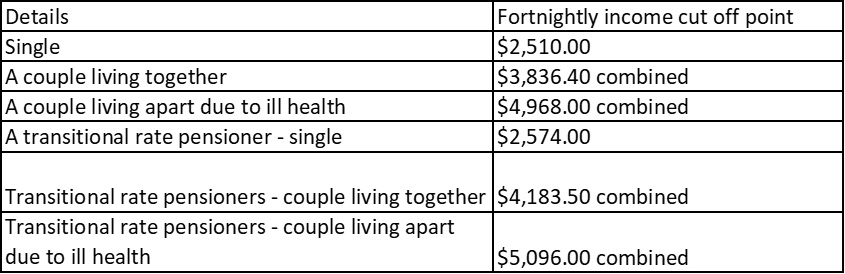

On the ground of income:

- For single applicants it should not exceed $212 per fortnight for the full pension and for a part pension it should not be exceed than $2510 per fortnight.

- For couples the combined income limit should be $372 per fortnight for the full pension and under $3,836.40 per fortnight for a part pension.

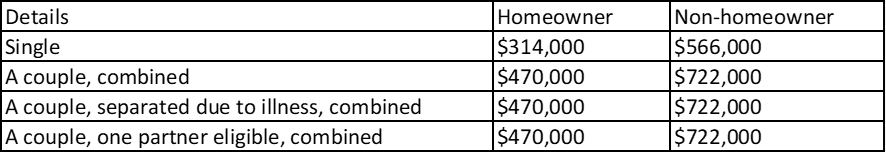

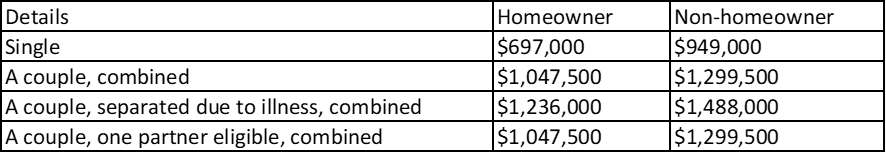

On the ground of Assets Test:

For single home owners:

- If they are applying for full pension then the asset value must be below $314,000.

- If they are applying for part pension then the asset value must be under $697,000.

For Couples:

- If they are applying for full pension then the asset value must be below $470,000.

- If they are applying for part pension then the asset value must be under $1,047,500.

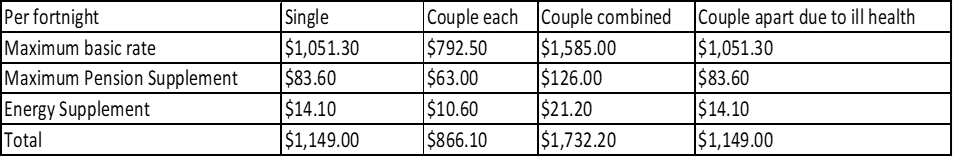

Payment Schedule and Amount to be disburse:

There are various terms and conditions regarding the amount which depends upon individuals who are single compared to those who are partnered. It is quite important to understand the pension income test and the assets test. Your age pension could be influenced by the earning or yours and of course if you have a partner and he/she is also earning. You must report any employment income received by you or your partner even if it falls below the income threshold. Here is the amount distribution on the ground of different parameters.

Date of receiving the check: 26.03.2025

Procedure to apply:

- If you have gone through the service Australia website, there are detailed explanations of the process you have to follow. First you have to prepare all the documents before applying. It must be at least 13 weeks prior to your 67th birthday. The documentation is important.

- For age proof provide birth certificate or passport

- For residential proof provide any of the utility bill or residency certificate.

- For Income and asset proof provide financial statements which include your income and assets;

- ITR records if necessary

- If you are applying the ground of couple then your relationship status with your spouse.

- After that make a claim via online. So you have to create you myGov account. Then connect your account to Centrelink by entering your Customer Reference Number (CRN). If you do not possess a CRN you can obtain one by visiting a Centrelink office and providing your identification documents.

- Then log in to your account and click on the make a claim option. Fill all the necessary documents over there.

- Check the documents uploaded by you.

- After all the process wait for the approval. The processing time may vary from a few weeks to longer depending on your situation and how correctly you have submitted your documents.

- After approval, payments are issued every two weeks and can be retroactively applied for up to 13 weeks from when you became eligible.

- If you cannot make a claim via online, then you can do it manually by filling the form and can submit that form by visiting a service centre near to you.