Earned Income Tax Credit 2024-25: Everyone who is a tax filer wants tax refund. Through return filling the filers get the important financial information. And after filing the return the filers wait for the credits available which is known as the Earned Income Tax Credit (EITC). How these refunds help the tax filers in managing their finances? The purpose of this refund is to assist low- and moderate-income workers by significantly lowering their federal tax obligations or providing a refund during tax season. If you are meeting the eligibility criteria or if you qualify the EITC can help reduce your tax bill or even result in a refund from the IRS.

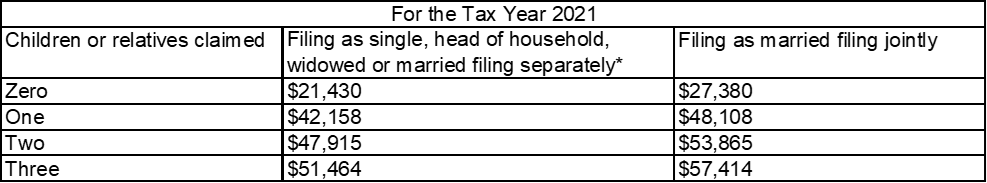

Understanding how it operates and when to anticipate your refund is essential. To be eligible for the EITC you must have earned income below $57,414 if you are married and filling the return jointly. And your investment income should be below $10,000 for the 2021 tax year. The tax filers should have their valid Social Security number by the due date of their 2021 return. We are talking about 2021 tax year because the last date of filing the return is 15th April, 2025. The tax filer has to be a U.S. citizen or resident alien for the entire year. And the filer must not file Form 2555 for foreign earned income.

If you are waiting for your tax refund, then hold your horses because it can be lengthy and constantly checking the status may not speed things up. To know where my refund is, one taxpayer can keep record of his own tax return. Visit IRS website page where you can monitor your refund status using basic details from your tax return. If you filed electronically then you can generally expect your refund to arrive more quickly than if you submitted a paper return.

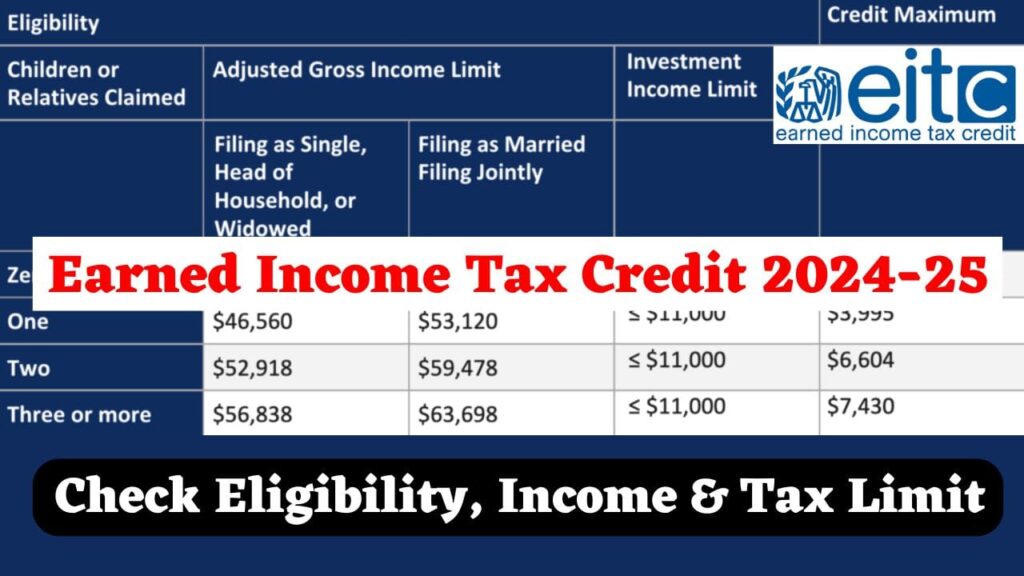

Earned Income Tax Credit 2024-25 Eligibility Check:

To get the eligibility done for Earned Income Tax Credit (EITC), the filers need to meet several criteria.

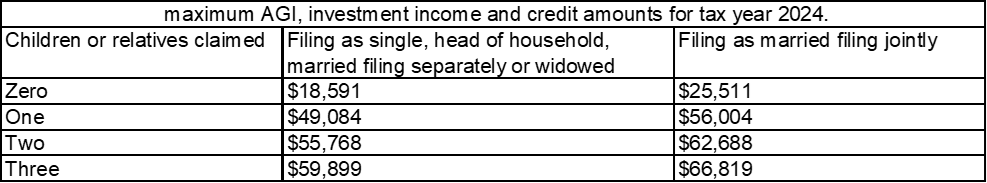

- The applicant’s earned income and investment income should be below a specified limit. And this varies year wise. For example, if you are filling for the tax year 2021 then you will see the table of 2021.

- The filer must possess a valid Social Security number by the time their tax return is due including any extensions.

- You should be a U.S. citizen or a resident alien for the entire year and cannot file Form 2555 for Foreign Earned Income.

- If you are staying single and are separated from your spouse and not filing jointly then there are specific rules you must follow.

- There are also unique qualifying conditions for military personnel, clergy, and taxpayers with disabilities or their relatives.

- If you are uncertain about your eligibility for the EITC consider using Qualification Assistant for guidance which is there in the IRS site.

How much you will get on the basis of how much investment amount for the tax year of 2021?

Foe the Tax Year 2024

The highest credit amounts available for claiming are as follows for the tax year 2021:

- If you are having no child, then you can claim up to $1,502.

- For one qualifying child you will get $3,618.

- If you have two qualifying children, then you can claim $5,980.

- You are eligible for the return of $ 6728 if you have three or more qualifying children.

Respective Dates:

There is an option available to the taxpayers, that they can claim the EITC for previous years within three years from the due date of your tax return. If you are meeting the criteria then you still have the opportunity to claim the EITC for earlier years.

- Tax Year 2023– the deadline of filing your return is April 15, 2027.

- Tax Year 2022- the deadline is April 15, 2026.

- Tax Year2021- the deadline is April 15, 2025.

How and what Forms you have to file to get the Refund?

- To get the refund you have to qualify for. You need to meet specific criteria and submit a federal tax return.

- Two form is there based on the age i.e. the filers can either file Form 1040 which is known as U.S. Individual Income Tax Return or Form 1040-SR which is U.S. Tax Return meant for seniors.

- If you are a filer and applying for the credit based on a qualifying child, then you must also include 1040 or 1040-SRalong with Schedule EIC. It is not necessary if you are claiming the credit without a qualifying child.

Know about your refund:

- As we know that every process needs some time. So you have to be aware about that. As per the rules and regulations the IRS cannot release EITC refunds until after mid-February.

- Most EITC refunds are expected to be deposited into bank accounts or onto debit cards by March 3.

- You can opt for direct deposit and there will be no complications with your tax return.

- Try to avoid common errors as any mistake can lead to delay in receiving the refund.

- You have the authority to check the status of your refund using the “Where’s My Refund?” tool or the IRS2Go mobile app.

- Always apply online or always file your tax return online and select direct deposit for your refund.

- You can e-file your return at no cost by utilizing IRS Free File.