Earned Income Tax Credit 2025: Taxpayers in America are now receiving additional financial assistance from the IRS under the Earned Income Taxpayers (EITC) program in the country. Eligible individuals are receiving the assistance as per the tax details and earned income in a financial year.

If you are also looking to get the benefit of this program, then you can read this article completely to understand the comprehensive overview of the program in this article, including the eligibility criteria, application process, benefits for beneficiaries, and all other details.

Earned Income Tax Credit 2025 – Overview

The income tax credits in the USA are provided under the Earned Income Tax Credit 2025 (EITC) program. All the taxpayers in the USA are eligible to get the direct benefits after paying the annual tax to the Internal Revenue Service (IRS). So if you are living in the USA and paying the regular tax, then you can apply for the program and receive the payment in the next 21 days after paying the tax.

The actual amount of the tax credit will be decided according to the income condition of the applicant and the tax details available on the earnings or Internal Revenue Service dashboard.

Earned Income Tax Credit Eligibility Criteria

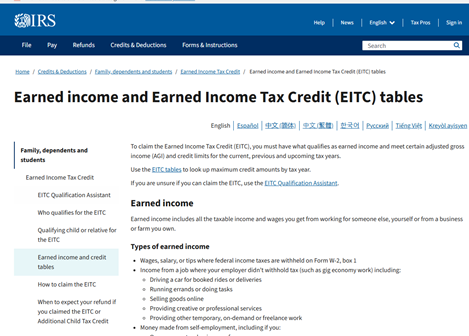

Firstly, you are required to check the certain eligibility condition mentioned by the Internal Revenue Service on its website to collect the benefit of earned income tax credits. Here is a detail overview of the eligibility criteria

- The program is only prepared for us citizens who are continuously working in America’s private or public sector.

- The second criteria is to be an adult applicant, where the minimum age of the applicant should be at least 18 years old while applying for the tax credit

- It is also important to pay the tax to the government without any delay annually and to clear your pending tax reports, if applicable.

- The deadline to pay the tax for the financial year of 2024 and 2025 was 14th April 2025. But if you still did not pay the tax, then you have the last chance to pay it by 18th October with all the delay and late fees.

- The benefit will be provided according to your income condition, so if you are earning a very low income, then you will get maximum tax credit from the authority.

$1395 Canada GIS Allowance 2025: Who Qualifies & When Payments Arrive?

CRA New Retirement Age 2025: Check CPP & OAS Benefits – Canada Retirement Age Increase

Benefits of Earned Income Tax Credit 2025 Program

You can submit the application form to receive benefits of Earned Income Tax Credit 2025 (EITC) Program. The Internal Revenue Service is managing the application form. But you cannot fill out the separate application form, as it is aligned with your tax details. So you will see an additional form while filing a tax to receive the benefits of EITC. Once you see the application form, you can follow the following procedure:

- Provide your basic details in the application form, including your tax information, number of family members including dependents, and earning individuals.

- After that you need to provide details of your spouse, whether they are earning or not earning or living with you or living separately.

- “Continue” details will automatically be fetched from the Internal Revenue Service dashboard, and you can click on “continue” to upload your comments.

- It will ask for your annual expenses and other expense details and their proof to upload in the document section, and after that, you can complete the application form accordingly.

Amount Earned Income Tax Credit 2025 Program

There is no fixed amount in the program, as it is completely based on your income condition and social status. If you are living with your children and spouse, then you can get a maximum benefit of $7830 under the EITC program. However you should check the following table to understand the income condition and other criteria to receive the full benefits

| No. of Children | Maximum EITC | Max. Income: Single or Head of Household | Max. Income: Married joint filers |

| 0 | $632 | $18,591 | $25,511 |

| 1 | $4,213 | $49,084 | $56,004 |

| 2 | $6,960 | $55,768 | $62,688 |

| 3 or more | $7,830 | $59,899 | $66,819 |

$7830 IRS EITC Refund 2025 Payment Date, Eligibility Rules & How to Claim

Earned Income Tax Credit 2025 Payment Date

There is no specific date for releasing the payment for the earned income tax credit in 2025, as it is provided as per the tax details. The earlier you submit your tax to the government on the Internal Revenue Services portal, the earlier you will be able to receive your tax credits accordingly. The department will release the payment after completing the verification procedure, which takes approximately 21 days. So if you have paid your tax, then you should wait for at least 21 days, and after that, you can raise the ticket to check the status of your tax credits.

The payment will be provided through direct deposits in the bank accounts of the beneficiaries. So you are required to update your bank details on the IRS portal to receive the benefits earlier without any error.