SSC CGL Salary 2024: Staff Selection Commission is the Central Government recruitment agency to recruit employees for different departments in India. Most of the youths who are preparing for government jobs are going to appear in the SSC CGL Exam 2024. SSC CGL is the very famous and toughest examination of SSC where recruited candidates get a good salary package according to their SSC pay Matrix and post. Today we will share with you the SSC CGL Salary per month according to their pay scale and pay grade. It will motivate you to qualify for the SSC Combined Graduate Level Examination and Will provide you the salary structures of the Government employees through SSC CGL Recruitment 2024.

SSC CGL is the comprehensive examination that is conducted at the graduation level where employees for different departments and posts are recruited according to their rank in the examination. Candidates get different positions such as GST inspector, Tax inspector, Sub-inspector, Senior administrative assistant, Accountant, junior accountant, auditor, etc. Where the salary of the employees starts from 25000 per month and goes up to 142400. However, it is only the basic pay of the employees, and the net salary includes multiple announces including dearness allowance, travel allowance, House and rent allowance, medical facilities, etc, apart from this they also get a monthly pension after retirement.

SSC CGL Salary 2024 Per Month

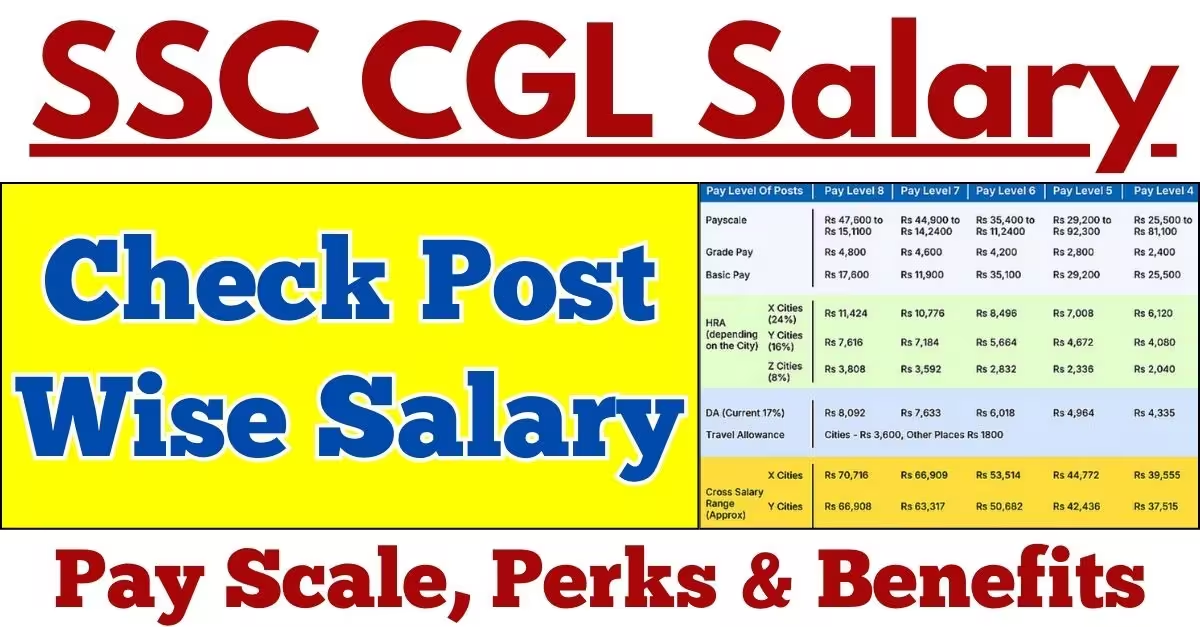

Government employees get the monthly salary according to their pay grade and pay scale according to the 7th pay commission. How much the pay level is high, employees receive a high salary package. All the Government employees in the central government get their salary through the 7th pay commission. There are currently 18th pay grades in 7th pay commission for designed peon to the secretary. But if you are focusing on SSC CGL pay grade then employees are recruited for the pay grade between Pay Level 4 to Pay level 8.

SSC CGL 4th Pay Level Salary

The upper divisional clerk, Sub-inspector, Tax Assistant, and SSA get their salary from the 4th pay level through the SSC CGL examination. The salary for the fourth pay level starts from 25500 per month and goes up to 81100 per month.

| 4th Pay Level- 25500 to 81100 | |

| Post | Group |

| Senior Secretariat Assistant/ Upper Division Clerks | Group C |

| Tax Assistant | Group C |

| Tax Assistant | Group C |

| Sub-Inspector | Group C |

| Upper Division Clerks | Group C |

Pay Level-5: INR 29,200 to INR 92,300

Auditors, Accountants, and junior accountants get a monthly salary according to the fifth pay level. The range of their salary starts from 29200 per month and goes up to 92300.

| Pay Level-5: INR 29,200 to INR 92,300 | ||

| Post | Office/Department | Group |

| Auditor | Offices under C&AG | Group “C” |

| Auditor | Offices under CGDA | Group “C” |

| Auditor | Other Ministry/Departments | Group “C” |

| Accountant | Offices under C&AG | Group “C” |

| Accountant | Controller General of Accounts | Group “C” |

| Accountant/Junior Accountant | Other Ministry/Departments | Group “C” |

SSC CGL Pay Level-6: INR 35,400 to INR 1,12,400

Very famous post office CGL is ASO, JSO, SI, Junior intelligent officer etc. All of them are included in the pay Level of 6 in SSC CGL Recruitment. Employees are receiving the basic salary from 35400 to 112400.

| Pay Level-6: INR 35,400 to INR 1,12,400 | ||

| Post | Group | Age Limit |

| Assistant / Assistant Section Officer | Other Ministries/ Departments/ Organizations | Group “B” |

| Executive Assistant | CBIC | Group “B” |

| Research Assistant | National Human Rights Commission (NHRC) | Group “B” |

| Divisional Accountant | Offices under C&AG | Group “B” |

| Sub Inspector | National Investigation Agency (NIA) | Group “B” |

| Sub-Inspector/ Junior Intelligence Officer | Narcotics Control Bureau (MHA) | Group “B” |

| Junior Statistical Officer | Ministry of Statistics & Programme Implementation. | Group “B” |

Pay Level-7: INR 44,900 to INR 1,42,400

| Name of Post | Department | Group |

| Assistant Section Officer | Central Secretariat Service, Intelligence Bureau, Ministry of Railways, External Affairs, AFHQ, Electronics and Information Technology | Group “B” |

| Assistant / Assistant Section Officer | Other Ministries/ Departments/ Organizations | Group “B” |

| Inspector of Income Tax | CBDT | Group “C” |

| Inspector (Central Excise) | CBIC | Group “B” |

| Inspector (Preventive Officer) | CBIC | Group “B” |

| Inspector (Examiner) | CBIC | Group “B” |

| Assistant Enforcement Officer | Directorate of Enforcement, Department of Revenue | Group “B” |

| Sub Inspector | Central Bureau of Investigation | Group “B” |

| Inspector Posts | Department of Posts, Ministry of Communications | Group “B” |

| Inspector | Central Bureau of Narcotics, Ministry of Finance | Group “B” |

8th Pay level salary in SSC CGL

Assistant audit officer and Assistant account officer are the high paid job in SSC CGL recruitment where these employees receive monthly salary between 47,600 to ₹ 1,51,100.

SSC CGL Net Salary 2024

SSC CGL employees receive several allowances enhancing their overall compensation, including Dearness Allowance (DA) to adjust for inflation, House Rent Allowance (HRA) based on the city of posting, and Transport Allowance (TA) for commuting expenses. They also benefit from Medical Allowance for healthcare costs, Leave Travel Concession (LTC) for travel expenses, and Children’s Education Allowance (CEA) to support their children’s education. Additional allowances like Special Duty Allowance for North-Eastern postings and various role-specific allowances further supplement their income.

For Example, An Assistant Audit Officer (AAO) in Pay Level 8, with a basic pay of ₹47,600 and posted in a metro city, can expect a monthly net salary of approximately ₹80,000 to ₹90,000. This includes a Dearness Allowance (DA) of ₹20,000, House Rent Allowance (HRA) of ₹12,852, Transport Allowance (TA) of ₹3,600, Medical Allowance of ₹1,000, and Children Education Allowance (CEA) of ₹2,250, along with other allowances such as Special Duty Allowance. After accounting for deductions such as Provident Fund (PF) of ₹5,712, income tax of around ₹3,000, and Professional Tax (PT) of ₹200, the net salary reflects the total take-home amount.